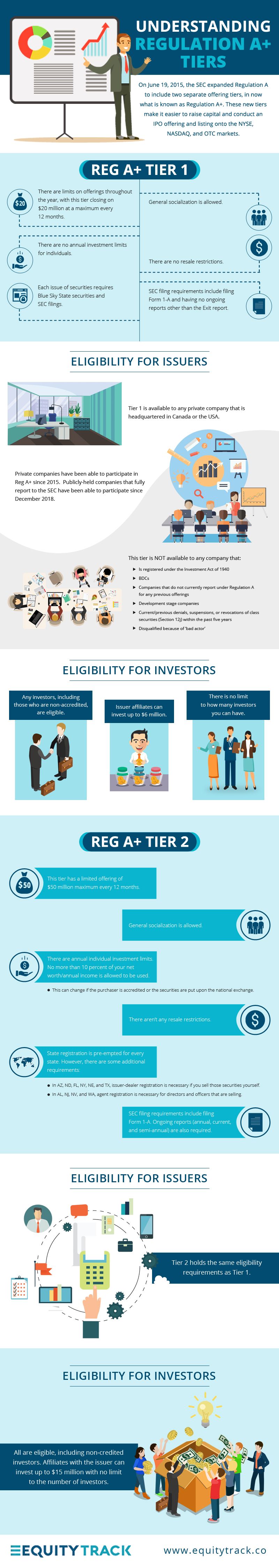

Limits on Offerings Within a Year

$20 million max per 12 month period

General Solicitation allowed?

Yes

Issuer Eligibility

Available to companies headquartered in the U.S. and Canada. Not available to existing fully reporting companies; companies registered under Investment Act of 1940 and BDCs; development stage companies; companies not current in ongoing reporting under Regulation A for previous offerings; current or previous denying, suspension, or revoking of class of securities pursuant to Section 12(j) within last five years; “bad actor” disqualification

Eligible Investors

Any, including non-accredited investors; Affiliates of the issuer can invest up to $6mm, no limit to number of investors in most cases

Annual Individual Investment Limits

None

State Requirement Exemptions?

Blue Sky state securities filings required in all 50 states.

SEC Filing Requirements

Must file Form 1-A, no ongoing reports except Exit report

Limits on Offerings Within a Year

$50 million max per 12 month period

General Solicitation allowed?

Yes

Issuer Eligibility

Available to companies headquartered in the U.S. and Canada. Not available to existing fully reporting companies; companies registered under Investment Act of 1940 and BDCs; development stage companies; companies not current in ongoing reporting under Regulation A for previous offerings; current or previous denying, suspension, or revoking of class of securities pursuant to Section 12(j) within last five years; “bad actor” disqualification

Eligible Investors

Any, including non-accredited investors; Affiliates of the issuer can invest up to $15mm, no limit to number of investors in most cases

Annual Individual Investment Limits

No more than 10% of the individual’s net worth unless the purchaser is an accredited investor or the securities will be placed on a national exchange upon qualification.

State Requirement Exemptions?

State registration is preempted except in these circumstances: “Issuer-Dealer” Registration is required for issuers involved in selling the securities themselves in AZ, FL, ND, NE, NY, TX. Agent Registration is required for any officer or director undertaking selling efforts in AL, NV, NJ, WA.

SEC Filing Requirements

Must file Form 1-A, and ongoing reports: Annual, semi-annual and current reports